This is the 12th post in Our Journey to Become Debt Free. To read the others, click here.

November was a great month. I didn’t think it would be, but it ended up being pretty eventful in Our Journey to Become Debt Free. We were waiting for Lucas’ hospital bills from October to be finalized and I was in the middle of opening my Etsy store. Both of those equate to a lot of nervous anticipation and money money money.

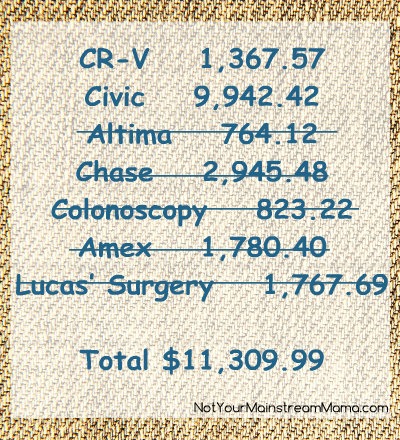

Here is the monthly progress we have made:

At the end of October, this is where we stood:

At the end of October, Lucas stayed overnight in the hospital with Croup. He recovered very quickly, but it was a very scary ordeal for us. I was also terrified of receiving the hospital bills. Even with insurance, medical bills make me sick to my stomach.

Throughout November, I signed on every few days to our insurance’s website and looked at what claims had been filed. At one point, 2 claims for some doctor were filed for a total of $78.00. The insurance discounted and paid and we were left with $13.73. Then, the pediatrician’s claim was filed for $249.00, processed and we owed $216.23. It would have been less, but we still had a $500 deductible left to satisfy. Next, the Emergency room company filed for $617.38, insurance processed and we owed $274.37. At this point, at a total of $504.33, our deductible was covered but I knew the hospital itself still had not filed a claim.

Finally, the week before Thanksgiving the hospital’s claim was filed. It was a whopping $10,080.98! I estimated we’d have to pay about $1,000 of that and the $504.33 for a total of around $1,500. I had not made most of our Snowball payments in October and did not make any in November. I carried over $430.53 in the Snowball budget category from October and set aside $256.76 in November for a total of $687.29 to go towards the medical bills. Then on the Friday after Thanksgiving, I looked and we only owed $322.91 to the hospital!!

With the other claims and the hospital, it was $827.24 for his ER visit and hospital stay. A little over half of what I thought it would be! I decided to use the $430.53 from October to make a payment on the CR-V and carry the $256.76 over to December for Lucas’ medical bills.

Another great thing happened; I received my final refund from the OBGYN’s office for overpayment for my prenatal care from Lucas. It took over a year, but at least I got it. That was another $420 to put towards the hospital bill.

We spent $393.54 on groceries in November, which is great! I blew my $100 Etsy/Blog budget though, coming in at $176.94. Yes, you should go to my Etsy store and buy something to help me make it up. Just kidding, kinda..?

We made a goal to pay off the CR-V before the end of the year. Although the $827.24 hospital bill was less than I thought it would be, it definitely threw a wrench in those plans. I’m not sure we’re going to make it.

We’ve caught up the Our Journey to Become Debt Free series! Starting in January, I will post a summary of our debt payoff activities for December and will continue to do that monthly for the month before. Right now, I have December’s post scheduled for January 3.

While we’ve never received a bill for LESS than we thought, I was over the moon when I received 2 different medical bills, one for part of the delivery of my daughter, and the other was a medical bill for her last year for one of her checkups. In the first case, ($112) it turned out the doctor had the wrong insurance information, so we didn’t have to pay that bill. The second was for her 18 month checkup, and apparently the insurance had the wrong DOB for her, so they saw her as only being 6 months old and receiving and 18 month checkup- so it was a “treatment that didnt correspond to her age”. After about 30 minutes on the phone with the insurance company, they got all the correct info, and refiled the claim.. so that was another bill we didn’t end up having to pay ($200). It pays to call back to verify info!! 🙂

LikeLike

Hey, money saved is money saved! It absolutely does pay to verify information with your insurance company and medical claims though. I called our insurance company and the OBGYN’s office 2 to 3 times a month for 15 months to get that $420 refunded. If I would not have looked into the claim and gone back to our coverage and saw that Maternity Care should have been 100% rather than the 80% they covered, I would have never gotten that money back.

LikeLike

Visiting you from SITS Saturday Sharefest!

Congratulations on your journey to becoming debt free! My husband and I went through this process back in 2011. Medical bills can really wreak havoc on your budget, but it was nice that it was less than what you thought it was going to be. That’s a great feeling!

LikeLike

Thanks for stopping by Tonya!

LikeLike

Medical bills make me sick to my stomach, too. We can avoid going into debt for things, but when someone is unwell we just don’t have many options. Ugh!

Congratulations on all the progress you’ve made. I hope you’re feeling more peace of mind at the end of the year than you did at the beginning. Thanks for sharing your story. It helps.

Happy Sharefest and best wishes for a wonderful new year.

LikeLike

Exactly. Yes, the end of the year is looking much brighther than the beginning as far as finances go. Thanks for stopping by!

LikeLike

What an awesome surprise! Almost like an early Christmas! Y’all have done really well over the last year to get things paid down, so even if you didn’t fully make your goal, don’t sell yourself short!

LikeLike

Thank you Leslie. I’m a pessimist, what can I say? 🙂

LikeLike

Congrats on becoming debt free. There is no greater feeling than having no debt, besides a mortgage and regular bills. We live mostly on cash since a bankruptcy. I never want to go back to those days! Keep chipping away at it and you’ll make it.

LikeLike

Well we do still have the one debt debt of the Civic loan left. But yes, it feels so great to be where we are! Thanks for stopping by!

LikeLike